Ownership Packages

Don't miss this opportunity. One time Investment lifetime halal income.

Ownership Packages

Enjoy Your Golden Moments With

Krishibid Sea Palace

Benefits of Ownership

Financial Returns

Dividend Income: Shareholders will recive regular dividend payments. High occupancy rates and premium pricing can lead to significant returns.

Stable Revenue Streams: Five-ster hotels often have steady cash flows due to consistent demand from affluent travelers, business executives and events, providing reliable returns.

Access to Exclusive Perks

Preferred Rates: Shareholders will receive discounted rates or complimentary stays at the hotel, enhancing the personal benefits of their investment.

VIP Treatment: Krishibid Sea Palace offer shareholders VIP services, such as priority booking, room upgrades and access to exclusive events or amenities.

Special Events: Shareholders may be invited to exclusive events, such as openings, galas or shareholder meetings, providing networking opportunities and access to influential individuals.

Prestige and Status

Association with Luxury: Owning a stake in a prestigious, five-star hotel can enhance a shareholder's status and reputation, particularly in business and social circles.

Brand Affiliation: Shareholders benefit from the association with a luxury brand, which can reflect positively on their personal or corporate image.

Liquidity

Ease of Sale: Shares in a hotel company especially if publicly traded can often be sold more easily than the hotel property itself, providing liquidity and flexibility.

Capital Gain: As the share price increases day by day, shareholders can gain capital by selling the share at a high value.

Social Impact and Contribution

Supporting Tourism: By investing in a five-star hotel shareholders contribute to the local economy, supporting jobs, tourism and community development.

Sustainability Initiatives: Many luxury hotels are increasingly focusing on sustainability and corporate social responsibility, allowing shareholders to align their investments with personal values.

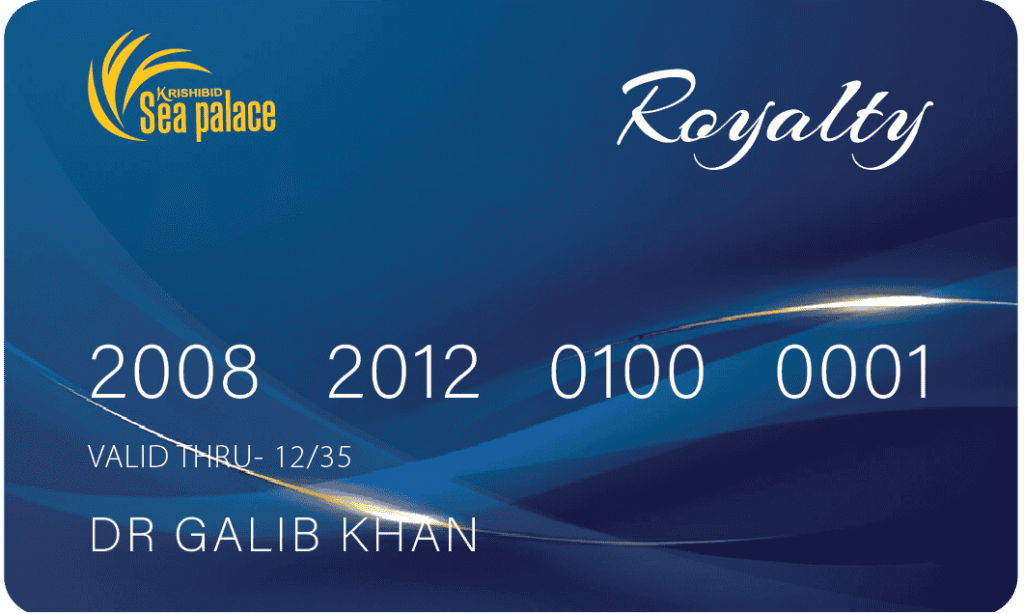

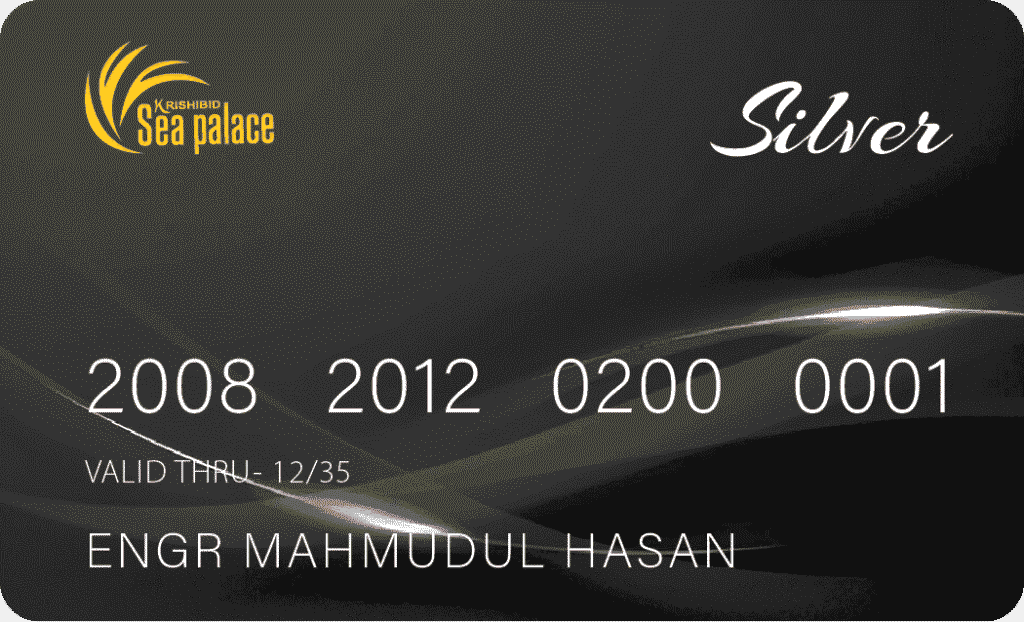

Our Privilege Partners

Enjoy your exclusive discounts by using our Privilege Card.

Subscribe Newsletter & Get Company Update.

Krishibid Sea Palace is a luxurious Five-Star Hotel in Kuakata. It is the first five-star hotel in the region under Krishibid Properties Ltd. It is a symbol of exclusivity, elegance and serenity beside the daughter of the bay of bengal.